Category: Taxes

Enjoy the standard mileage rates when you file 2016 taxes!

The IRS issued a change on Dec. 13, 2016, decreasing the standard mileage rates used to…

Tax refund delays: Not in time to pay for Christmas!

Tax refund delays should be expected this filing season. The IRS recently reminded tax filers…

2017 tax due dates tightened.

On July 31, 2015, President Obama signed into law legislation tightening 2017 tax due dates of informational forms,…

Everybody has a tax bracket.

Do you know your tax bracket and how the IRS controls it? Our federal tax system is based on a progressive calculator…

IRS Impersonators are aggressive, convincing con artists.

Nobody really wants to have personal contact with the IRS; and nobody ever wants to be…

The IRS only has the time and budget for “a few good audits.”

Budget cuts have made the IRS relook the discipline of working smarter. Knowing how to…

Make your own breaking news: No Tax Cheating!

Earlier this month, Catherine Rampell, The Washington Post Writers Group, wrote her breaking news…

Millennials resist traditional marriage.

When Millennials make the decision to become a couple, their wedding app may click them from great…

Married filing separately. Think about it.

Yes, you’re married, but you’re still an individual. You’re each unique. Sometimes that is exactly what…

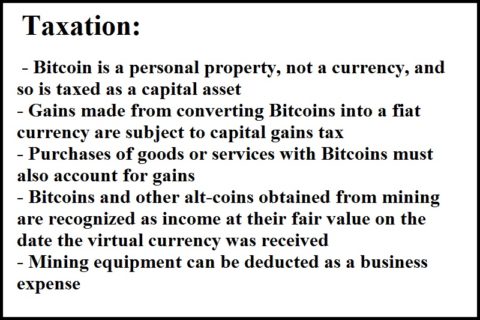

IRS considers virtual currency as property

Here is a compact review of the IRS notice from 2014 which puts the recordkeeping and valuation of…