Category: Tax Cuts and Jobs Act of 2017

Tax gaming, tax avoidance and tax evasion. Legal or illegal? Although all sound ominous, they’re not all illegal, but they’re all…

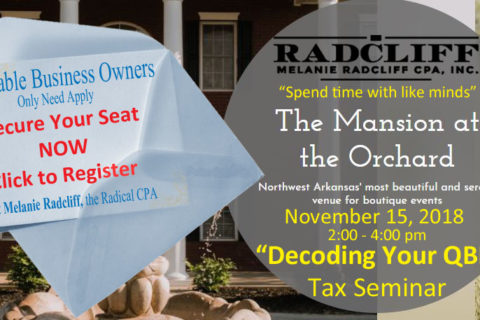

Profitable business owners get that way by being gutsy, grabbing every tax advantage, and knowing how to run a business! But most business owners…

Don’t let the IRS take your money. You’re a business owner. Why would you let the IRS take your money? They’ve given you all the information you need…

The IRS blended tax rate is the result of a provision in the Tax Cuts and Jobs Act (TCJA) in which a corporation with a fiscal year that includes…

Deed the home to the kids? Children and parents have long battled the wisdom of allowing elderly parents to retain home ownership. The transfer of…

The new territorial tax system replaced the worldwide tax system within our tax laws when the Tax Cuts and Jobs Act was signed into law. This…

Your hobby profit and loss situation may be your tightly-held secret, but the IRS knows how to get into your business. Literally! The more secret…

If you think you’ve been overpaying IRS business taxes, do you really plan to keep doing that? Actually, I’m curious as to how you came up with the…

Deciding to file jointly or separately has a few new considerations for the 2018 tax year. Some couples believe there are no secrets, including…

No more child tax credit exemption and a zero percent tax bracket? How do these work together to make the perfect business and individual tax…