Category: Financial Counseling

A Health Savings Account (HSA) can save you money on medical expenses such as doctor’s visits, prescriptions, and other qualified medical…

Millennials turning 26 years old are celebrating this birthday as a milestone. According to a recent survey, it’s embarrassing if you…

As adults, trust fund babies often face the limitations of complicated trust structures or find themselves the recipients of an incomprehensible…

Federally Declared Disaster designation laws and TCJA of 2017 make claiming casualty loss tax deductions impossible for some victims of fire, flood,…

FinCEN follows the money by looking at who does and doesn’t file an FBAR (FinCEN Form 114) directly to their agency, the Financial Crimes Enforcement…

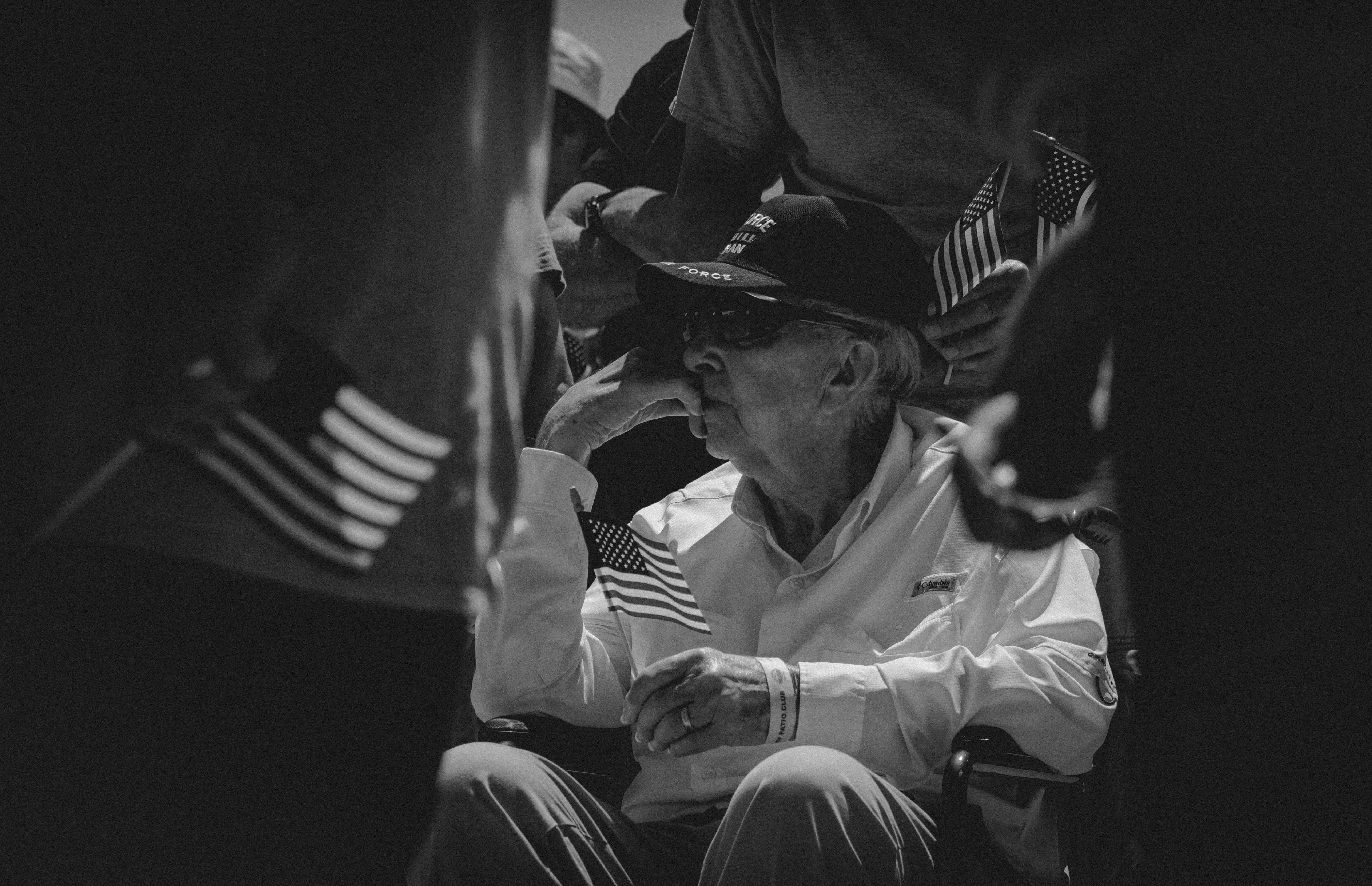

Veterans and surviving spouses benefits, through the Aid and Attendance Veterans Benefits, will have some dramatic changes made effective October 18,…

“Last Will and Testament of…” Words family members never want to hear can become even more traumatizing during a time of heartbreaking loss when…

A reverse mortgage is a home equity conversion mortgage (HECM). It also provides a loan available to seniors 62 years or older, complete with closing…

Alimony payments and new tax laws, part of the Tax Cuts and Jobs Act of 2017, make radical changes in how alimony income and deductions are handled.…

IRS mortgage insurance deduction for the 2017 tax year was one of the 30 deductions eliminated with the December signing of the Tax Cuts and Jobs Act…