Category: Business Management

A profit and loss statement (P&L) is one in the trio of financial statements which together can reveal what is, has and could happen to your…

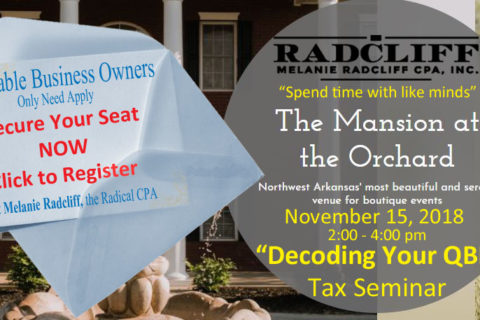

Profitable business owners get that way by being gutsy, grabbing every tax advantage, and knowing how to run a business! But most business owners…

Working under the table or paying someone under the table is “unreported employment” usually paid in cash since it’s harder to trace. According…

Cost segregation of commercial real estate provides a business owner with tremendous tax advantages when purchasing or constructing a building.…

QBI tax deduction? That means qualified business income. If you don’t take advantage of this deduction, the IRS will. In case QBI tax deduction…

Business tax strategy which included meals and entertainment was once a mainstay for the business owner’s personal lifestyle. Seldom did he need to…

501(c) business subsections face challenges in 2018 with unknowns and certainties of change resulting from the Tax Cuts and Job Act of 2017 and the…

What is a single-member LLC and who benefits?

A single-member LLC begins as a corporation, complete with filed articles of incorporation, and first…

The right business entity selection is your key to business success. The choice can be one of the most confusing and important decisions a business…