Bitcoin and Cryptocurrency Users Get IRS Snail Mail

The IRS is paying close attention to Bitcoin and cryptocurrency transactions and has sent letters to cryptocurrency users. A nice way to say, “We know who you are, what you’ve done, and where you live.”

Are Bitcoin and cryptocurrency the same? Merriam-Webster has a clear definition which shows how the two words work together. Also clears up their relationship:

Bitcoin, however, has become the cryptocurrency standard operating much like U.S. dollar would operate in public currency markets, but in the crypto realm.

Bitcoin and cryptocurrency users get snail mail

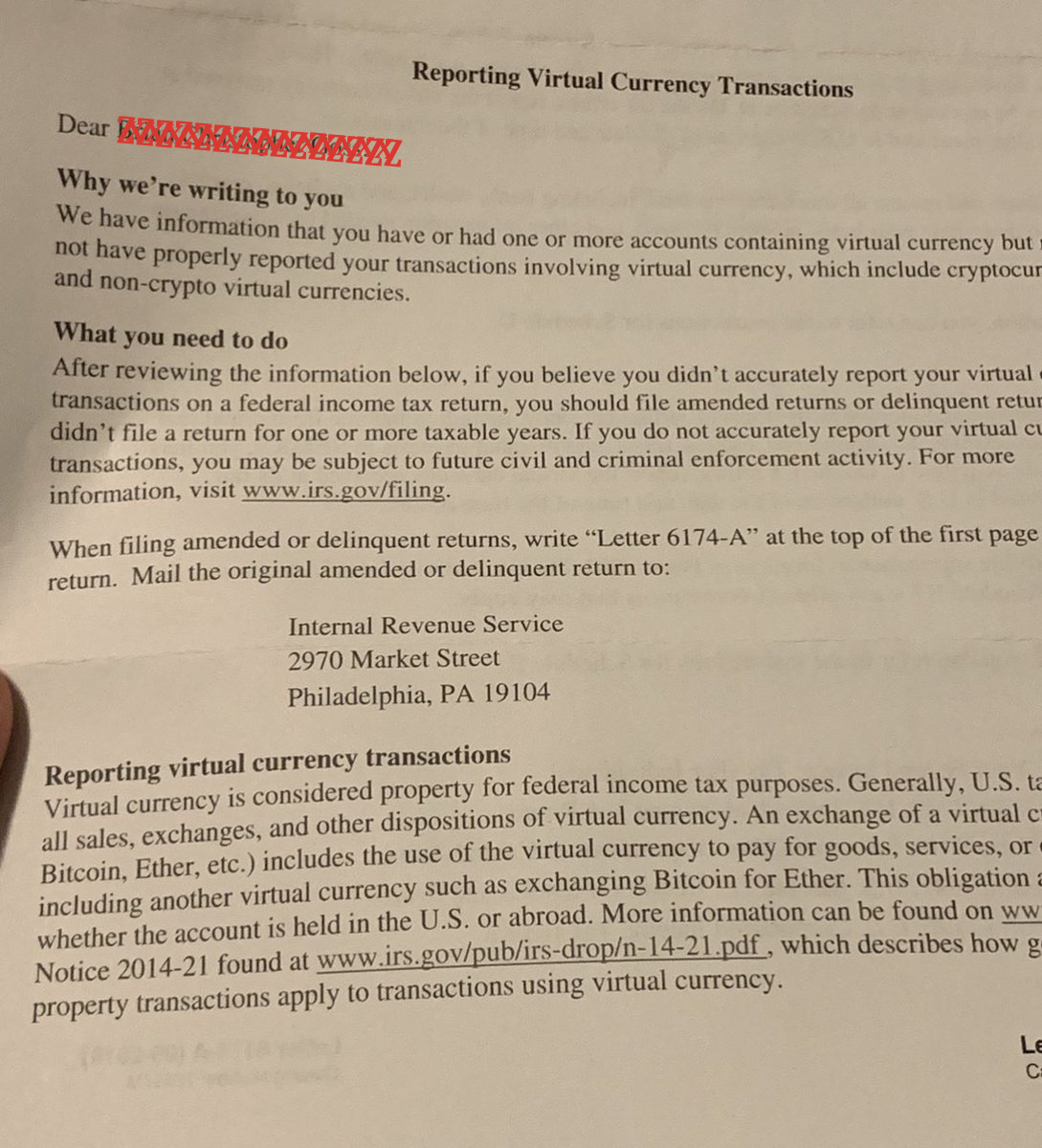

Two of the IRS letters recently sent were informational and indicated the IRS was aware of the individual’s participation in cryptocurrency trades. One of the letters (IRS letter 6173) required a signed declaration under penalty of perjury. Within a few days, the IRS sent another letter (CP2000) to cryptocurrency users who reported numbers that were materially different from what exchanges supplied to the IRS. Below is an example of information being supplied to the IRS by exchanges:

On November 22, 2017, a San Francisco federal judge ruled that Coinbase must supply the IRS with identifying information on users who had more than $20,000 in annual transactions on its platform between 2013 and 2015. Coinbase pushed back and narrowed results applying to some 10,000 accounts that have bought, sold, sent, or received more than $20,000 in any of those type transactions between 2013 and 2015. Techcrunch

On February 23, 2018, Coinbase told approximately 13,000 affected customers that the company would be providing their taxpayer ID, name, birth date, address, and historical transaction records from 2013-2015 to the IRS within 21 days. Wikipedia

Bitcoin and cryptocurrency are taxing IRS patience

By mid-2017, most everyone knew the IRS had compiled some information on their virtual currency (cryptocurrency) activity. The IRS updated their March 25, 2014 position by reaffirming that they would continue treating virtual currency as property for US federal tax purposes. By December of 2017, the IRS watched red flags waving and green dollar signs sprouting. New tax revenue along with growing penalties had the IRS humming to the tune of Its Beginning to Look a Lot Like Christmas.

Owners of Bitcoin and other cryptocurrencies, already high-risk-tolerance individuals, responded by betting against an IRS audit.

On April 15, 2018, I updated my original blog Who Owns Bitcoin […] to report IRS findings relative to 2017 tax filings. Amazingly, as of April 13, 2018, reports showed only a small fraction of individuals had ponied up to the IRS and claimed any capital gains associated with cryptocurrency holdings.

A state of confusion still exists. There remains a lack of clarity from the IRS and insufficient accountability tools for cryptocurrency investors. The majority of retail investors did nothing. In other words, they did not include any cryptocurrency-related activity on their 2018 tax returns.

I earned my reputation as The Radical CPA

Questions? 479-478-6831

Let’s talk

The IRS is about Fed-up

Thus the mailing of 10,000+ informational letters including a separate firm warning. One recipient shared his IRS warning on Twitter:

“Anyone get one of these IRS notices? I payed taxes on bitcoin gains during the last two bubbles, so I’m guessing they send these to all people who declared #bitcoin gains? I declared a cost basis of 0…which is essentially true (I mined back in 2010, so I spent like pennies)…”

Chuck Rettig, IRS Commissioner since September 2018, adds, “Taxpayers should take these letters very seriously. The IRS is expanding efforts involving virtual currency, including increased use of data analytics.”

The IRS has also been acting as a participating member of the Joint Chiefs of Global Tax Enforcement (J5) group. The J5 was formed to investigate crypto-related financial crimes, including money laundering and tax evasion. In June 2019 IRS Criminal Investigations warned that J5 had “found innovative ways to tackle these problems, remove barriers, and develop processes” to deal with cryptocurrency-related crimes.

Key take-aways

- A lot of your money is sitting on the table, and the IRS intends to get their share.

- You must report virtual currency transactions on your return, regardless of whether you received a payee statement for the transaction (such as a Form W-2, Form 1099, etc.).

- If you failed to report such transactions on previous returns, you should consider amending those returns.

- Pay attention! Guidance for reporting originally came from 2014 IRS rules which indicated owners apply the exchange rate, in a reasonable manner that is consistently applied. Recent IRS letter instructs traders to look at the exact date and time of purchase and use that price to calculate the value.

- The IRS is applying new standards and requirements for taxes on transactions conducted between 2013 and 2017. New guidelines are forthcoming.

- It appears the IRS group developing new guidance is not coordinating with the team who wrote the letters. Any new guidance will have to pass through several layers of approval, including the U.S. Treasury Department (which the IRS falls under).

- The IRS is right until proven otherwise. The burden of proof is on the taxpayer, and that burden comes with a high price tag.

The bottom line

It will be difficult for taxpayers to certify to the IRS, under penalty of perjury, that they have complied with rules that are not yet published. But the IRS knows what it’s saying: If you used cryptocurrency, you have engaged in a reportable transaction.

I can become your CPA tax specialist and business financial adviser. We can provide you the advantage of knowledge and strategy so you can have the control you need and want.

Call us at 479-478-6831 or you can email us.

I earned my reputation as The Radical CPA

https://www.radcliffcpa.com/tax-gaming-tax-avoidance/