10 Most Expensive Tax Mistakes

If you think you overpay business taxes, do you plan to keep making the same expensive tax mistakes? Tax-savvy business owners grab every tax advantage the IRS offers, but most business owners JUST DON’T GET IT, and the IRS knows it.

Use The Tax Cut and Jobs Act of 2017 to keep your own money, or the IRS will take it away from you! You still have time to make changes BEFORE December 31, 2019, and stop making expensive tax mistakes!

Want to keep more of your own money?

REGISTER NOW

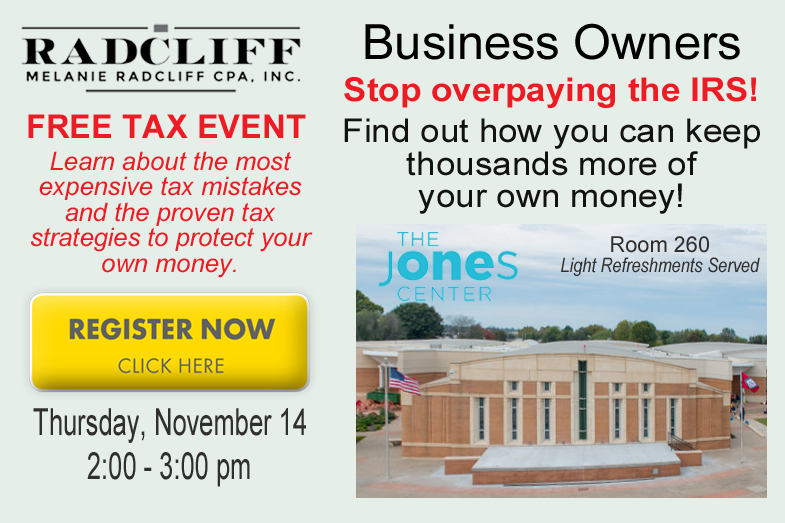

Arkansas River Valley Event at Fort Smith Public Library

$100 Gift Card Door Prize to Texas Roadhouse in Fort Smith

Northwest Arkansas Event at The Jones Center, Springdale

$100 Gift Card Door Prize to Ruth’s Chris Steak House in Rogers

Goals + PLAN + Strategies = SUCCESS $$

I earned my reputation as The Radical CPA

10 most expensive tax mistakes business owners make

- The most expensive tax mistake business owners make is NOT USING the key to your financial defense that guarantees results! Your BEST FINANCIAL DEFENSE is a FOUR LETTER WORD that guarantees you keep more of your own money! We’re going to talk about that FOUR LETTER WORD, and you’re going to start using it! PLAN on it!

- Waving red flags at the IRS is always a mistake! Fly under the IRS radar and slash your audit risk! May sound complicated, but we’re going to talk about merely flipping the switch from fearing the IRS to respecting the IRS. Find out how to turn your AUDIT PARANOIA into AUDIT AVOIDANCE. Get ready to tip your hat to the IRS as you give them a thumb to your nose.

- Using the wrong business entity is a BIG mistake! Your choice may have been right at one time, or it may not have ever been the best decision. Either way, get over it, LET’S FIX IT. You might do a lot of other things right, but if you dig your heels in on this one, go ahead and give the IRS a signed blank check! NOT.

- Choosing the wrong retirement plan or NOT having one! These opportunities range from ZERO to TURBOCHARGED. Are you benefiting from safe harbors, extra “catch up” contributions, covered comps, solo plans…and the list goes on! If you’re not 100% sure what all these mean, now is a GOOD TIME TO FIND OUT!

- Not hiring the kiddos is a No-No. Family bonding time meets tax avoidance beneath the cool umbrella of the U.S. Tax Code. Think summer camp for your teen turns into a business expense! Count on it, or you can pay tax on it. Hiring your children and grandchildren can be a great way to cut taxes on your income by shifting it to someone who pays less.

- Missing medical expenses for yourself, the kiddos, and even your retired parent! How the heck-fire does this work? How about writing off medical bills as business expenses, so you don’t lose them on that 1040 10% floor? Consider this your Section 105 “employee” benefit plan, and we’ll help you write it!

- Failure to claim your home office deductions. Even if you have another office, claiming a home office doesn’t raise IRS red flags. If you’re overly worried about it, we’ll help you decide whether percentages or the safe harbor route is best. Just chill out and work in your ‘jammies.

- Missing car and truck expenses. The standard deduction of 54 cents per mile is applied no matter what type of vehicle is used and usually adequately covers a small sedan. Drive a 4WD SUV or large sedan, and according to AAA Driving Costs Survey, you might as well toss 17 cents out the window every time you pass a mile marker. There’s a fix for this!

- Failing to audit-proof your meals and entertainment can get messy! The IRS expects you to have answers for five specific questions about each little outing, but you don’t need receipts for expenses under $75.

- Missing this FREE TAX EVENT is a BIG, expensive tax mistake! Your BEST TAX DEFENSE is a FOUR LETTER WORD that guarantees you keep more of your own money! I’ll use this FOUR LETTER WORD a lot! PLAN on it.

Goals + PLAN + Strategies = SUCCESS $$

I earned my reputation as The Radical CPA

The IRS is hoping you’re a NO-SHOW

and that you continue paying them more than you should!

Go ahead, click and register, you know you want to!

Fort Smith Public Library, Fort Smith

The Jones Center, Springdale

I look forward to meeting you!

And the IRS hopes you NEVER meet me!

__________

What’s the bottom line?

Whether you’re a business owner or not, every person should have a proactive, planned tax strategy. Don’t just wait for your tax person to tell you what probably happened last year and then tell you how much more you owe.

Don’t let the IRS take your money!

You can have the same opportunities as my clients have to control your financial future. I can become your CPA tax specialist and financial business and life goals adviser, and you can have the control you need and want.

Our goal is to become part of your overall life and business goal planning team so that you’ll be able to establish your own goals and know that you have a trusted professional on your side. We build and maintain a personal and business relationship with our clients. Your LIFE is your business, and your BUSINESS is your life. We’re here for YOU.

Call us at 479-478-6831 or you can email us.

To schedule an appointment with Melanie Radcliff, you may also use our Online Appointment Scheduling option!

I earned my reputation as The Radical CPA

If you don’t keep your money, the IRS doesn’t mind taking it!