The Man with the Tax Free Bag

Our Holiday Wishes with a Tax Free Twist

These days it seems like every day brings new controversy to further divide Americans: red states squaring off against blue states and partisanship crossing the line into tribalism. And that’s just as true with the holidays as with anything else. Is fruitcake really an abomination? Is Die Hard really a Christmas movie? Is Baby It’s Cold Outside really a musical #MeToo violation in two-part harmony?

Fortunately, there are still some headlines that can bring us all back together. So this holiday season, we’re especially delighted to remind you that A Visit From Saint Nick is a tax-free celebration. Santa won’t be leaving a 1099 under your Christmas tree, and there won’t be any Form 1040-GIFT to file after the tree comes down.

Taxable income generally includes all income, from whatever sources received. However, the tax code carves out several exceptions to that rule, much like Grandpa carves the drumsticks out of the holiday turkey. A “gift” is something of value, given without expecting anything in return. IRS Publication 525 states that “in most cases, property you receive as a gift, bequest, or inheritance isn’t included in your income.”

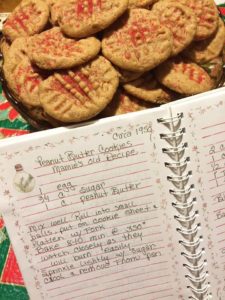

“But what about the milk and cookies?” you might ask. “That’s the deal, right? Santa shows up with a bag of presents in exchange for cookies and milk (or maybe bourbon and eggnog). Doesn’t that transform the whole occasion into a taxable exchange for value?” To which we might respond, “How did you get to be such a Grinch, anyway?”

“Ok, then, what about the gift tax?” you might challenge us next. Well, for starters, that’s a levy on your right to give, not receive. So there’s never any tax due to the recipient. You can give up to $15,000 each to as many people in a year as you like. If you’re married, you and your spouse can join together to give up to $30,000 to every lucky winner. If you give more than $15,000 to a single recipient in a single year, you’ll have to report the excess on Form 709. But even then, you won’t owe actual tax until your lifetime taxable gifts exceed $11.18 million. With those rules in mind, Santa’s gotta’ be awfully generous before Christmas morning turns into a taxable event, even for him. (Granted, a trip to Tiffany’s might do the trick.)

But there’s one last scenario to address — and one last loophole to highlight — before we finish our discussion. That’s the Christmas Morning Car, an advertising staple since Lexus launched their “December to Remember” campaign back in 1998. What happens when Santa leaves a shiny new car wrapped in a big red bow in the driveway?

This is the part where we’re going to have to shatter some precious childhood illusions. Sorry, boys and girls, but that’s not really Santa leaving that Lexus in the driveway. It’s just Mom buying the car for Dad, or Dad buying it for Mom. And transfers between spouses are tax-free up to any amount. Which means, once again, that the IRS won’t be taking a bite out of your Christmas cheer.

Like everyone else, we wish you the best this holiday time, whether you celebrate Christmas, Hannukah, Kwanzaa, or even Festivus.

But we want to offer something a little more tangible. Help us give you the gift of Proactive Tax Planning. Call us when you’re ready to save, and together we’ll make the season even brighter!

Want to find out more about us?

If you haven’t made a decision to work with a full service CPA, I look forward to becoming part of your overall life and business goal planning team so that you’ll be able to establish your own goals and know that you have a trusted professional on your team. We establish and maintain a personal and business relationship with our clients. Your LIFE is your business and your BUSINESS is your life. We’re here for YOU.

Call us at 479-668-0082. Use my Calendly Page (it’s easy) to set an appointment or you can email us.

You might also like to check these out:

Lexus and the December to Remember