Overpaying IRS Business Taxes? You Haven’t Seen Anything Yet!

If you think you’ve been overpaying IRS business taxes, do you really plan to keep doing that? Actually, I’m curious as to how you came up with the plan and why you would even consider sticking with it. That’s reason enough for you to contact me right now!

Overpaying IRS business taxes can be totally avoided.

You’ve probably heard that the Tax Cut and Jobs Act of 2017 is full of tax saving opportunities. If you know, think or feel like you been overpaying IRS business taxes, and your tax person hasn’t already been talking to you about this, I’ll tell you what the IRS gave you.

The IRS gave you a GIFT. The card reads OPEN IMMEDIATELY. It’s intricately wrapped, secured with invisible tape and decorated with ribbon and bows. Inside are rewards! If you’re able to unwrap it and you have the Decoder Ring, you can read everything inside. If you can’t open it and decode the message, chances are nearly 100% that you’ll again be overpaying IRS business taxes for the tax year 2018. By how much? Well, if you thought last year was bad, you haven’t seen anything yet!

I am morally opposed to my clients overpaying their taxes.

What’s in the Tax Cut and Jobs Act for you?

The IRS made it possible for business owners to receive this gift of REWARDS for doing certain things. Your gift is full of things you can do to receive these rewards. That is PLEASURE.

The backhanded part of this is that if you don’t do these things, you’re definitely going to feel the PAIN when you PAY the IRS because you didn’t accept the rewards. In other words, if you can’t figure out how to open your gift and use what they put in it, you’re going to feel some serious pain when your tax person gives you those final numbers.

Pain or pleasure? Two sides of the same coin.

You may be the type person who will do what it takes to avoid the PAIN OF PAYING. Or you may be someone who will do what it takes for the PLEASURE OF SAVING your own money! Statistics show that pleasure, the pursuit of happiness, is a stronger motivator than fear.

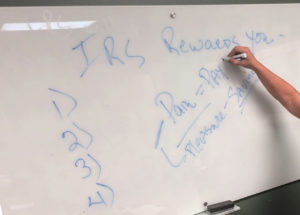

Recently, several of my clients got together in my office and we actually talked about the rewards, savings, deductions, the opportunities, that are available to the taxpayer. Especially the business owner trying to do the right thing for their employees, family and their business. It was easy for me to get carried away, and somebody said “put it on the board.” I erased a bunch of random notes and we got to work.

Recently, several of my clients got together in my office and we actually talked about the rewards, savings, deductions, the opportunities, that are available to the taxpayer. Especially the business owner trying to do the right thing for their employees, family and their business. It was easy for me to get carried away, and somebody said “put it on the board.” I erased a bunch of random notes and we got to work.

You know, I could say I’m not going to tell you what I wrote to fill in the blanks after the numbers, but I don’t work that way. I also don’t give you just enough info to make you think you’ve suddenly got 25-plus years of knowledge and can go it alone. No joking when I said it takes the Decoder Ring to get it right. And I’m definitely not joking when I tell you that I have the Decoder Ring! That’s how much I know about the tax laws. Most of my clients start asking questions when I bring up a topic that might make a difference for them. That’s when they want to know more and we really get down to work!

Don’t continue overpaying IRS business taxes? Here are 1, 2, 3, 4 clues!

Okay, that may be a lame attempt to increase my SEO, but this is where I fill in the blanks! If you’re really serious about changing the outcome of your tax liability, let’s start with 4 great ways to keep, save and grow your own money:

- Investing. In what? How? It’s not in the stock market, but there’s a very good reason I listed it first.

- Payroll. The IRS set into motion opportunities for you to save 20%. Of what and how? Come on, 20% should get your attention. Remember, it’s all about keeping your own money.

- Golden Years. Retirement. Here is something you can help make available for your family, yourself and the people who help make your business a success.

- Doing it right. First, last and always, this comes before you can even take aim at success. If this sounds like a circle, you’re right. Lets look at how your business is set up and why. It’s not just a circle, it’s a target you must hit if you want to win.

Anything else?

Sure, always is. If you think you’ve been overpaying taxes, you’re probably right! And if you’re not making substantial tax planning changes, I can say with confidence that you’ll again feel the pain of overpaying the IRS when you (if you’re a DIYer) or your tax person finish your 2018 tax year returns.

What’s the bottom line?

Whether you’re a business owner or not, every person should have a proactive, planned tax strategy. Don’t just wait for your tax person to tell you what probably happened last year and then tell you how much more you owe.

You can have the same opportunities as my clients have to control your own financial future. I can become your CPA tax specialist and financial business and life goals adviser and you can have the control you need and want.

Our goal is to become part of your overall life and business goal planning team so that you’ll be able to establish your own goals and know that you have a trusted professional on your team. We establish and maintain a personal and business relationship with our clients. Your LIFE is your business and your BUSINESS is your life. We’re here for YOU.

Call us at 479-668-0082. Use my Calendly Page (it’s easy) to set an appointment or email us.