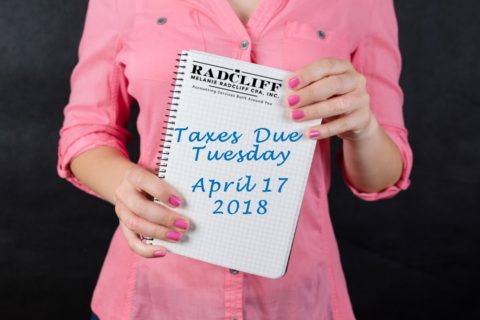

Month: April 2018

Late tax filing is no big deal if the IRS owes you a refund. In fact, if you just plain forgot to file, the IRS might keep forgetting until you waved…

501(c) business subsections face challenges in 2018 with unknowns and certainties of change resulting from the Tax Cuts and Job Act of 2017 and the…

Worrying about what to bring to your tax appointment may not be worrying you as much as the fact that you haven’t already filed your taxes!

If you…

If you’re a rental property owner, every tax season you probably ask if the benefits of rental property tax deductions and the income are really…