IRS 2017 tax law affects standard deductions and could hit taxpayers hard

Everybody keeps asking how the 2017 tax law affects standard deductions. Using my second baseball analogy, I’ll call it the smash. That can be a game changer. So, you could end up feeling like you got hit very hard, and maybe even squished.

The smash: Success or failure, for a batter, comes down to something that happens in a split-second–the collision between a bat and the ball. The ball ends up kind of squishing.

Read more from Science News for Students Baseball: From pitch to hits and find out what happens to the ball when it gets hit this hard!

2017 tax law affects standard deductions and exemptions

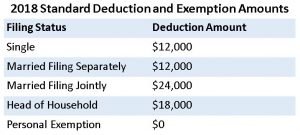

For comparison, here are 2017 standard deduction and exemption amounts. Your federal IRS 2017 tax returns, which are being filed in 2018, is the latest tax year for which these deductions and exemptions are allowed.

_____________________

Note: The 2018 IRS personal exemption is completely eliminated.

What about your side gig or your Schedule C business?

Start with this if you file a Schedule C for your business expenses. Read this for more about C Corp or S Corp structure.

_______________________

Individual deduction and exemption changes

These are some of the important and critical tax changes that should be considered early in 2018 so that your tax strategies can be adjusted immediately.

- Tax rates: The new tax law lowers rates for individuals and adjusts bracket amounts. For 2018 through 2025, the tax bracket rates are 10%; 12%, 22%; 24%; 32%; 35% and 37%. In addition, a chain CPI index will be used for future indexing, thereby reducing the size of annual adjustments.

- Standard deductions: The standard deduction is effectively doubled to $12,000 for single filers and $24,000 for joint filers, while the additional standard deductions for the elderly and blind are retained.

- Personal exemptions: Personal exemptions, including exemptions available for qualified for dependent children and relatives, are repealed. Accordingly, the personal exemption phase out (PEP) rule also goes away.

- Alternative minimum tax: The alternative minimum tax (AMT) system is retained, but exemption amounts, as well as the thresholds for phasing out exemptions, are significantly increased. In addition, these figures will be indexed for inflation in future years.

- Child tax credit: The child tax credit (CTC) is doubled from $1,000 per qualified child to $2,000, subject to a phase-out for high-income taxpayers. Under a late amendment, $1,400 of this credit is refundable. In addition, the new law creates a $500 nonrefundable credit for non-child dependents.

- State and local taxes: In a controversial provision, the TCJA limits the deduction for state and local income taxes (SALT) to $10,000 annually for any combination of state and local property taxes or (2) state and local income taxes or sales taxes.

- Mortgage interest: Although deductions for prior debt is grandfathered, the new law limits the mortgage interest deduction to interest paid on the first $750,000 of acquisition debt, down from $1 million.

- Home equity debt interest: The 2017 tax law also also eliminates deductions for interest paid on home equity debt.

- Medical expenses: While other itemized deductions are eliminated or scaled back, the deduction for medical expenses is temporarily improved. For 2017 and 2018, the threshold for deducting medical expenses reverts to 7.5% of AGI, the threshold in effect prior the law prior to the Affordable Care Act (ACA).

- Casualty and theft losses: This itemized deduction is eliminated, but it is preserved, with certain modifications, for losses incurred in federal disaster areas.

- Section 529 plans: The list of qualified expenses for Section 529 plans is expanded to include tuition at an elementary or secondary public, private or religious school, plus home schooling expenses, for up to $10,000 per year.

- Roth IRAs: The rule permitting taxpayers to recharacterize a Roth IRA back into a traditional IRA after a conversion is repealed.

- Health insurance: The new law repeals the health insurance mandate for individuals established by the ACA. This change doesn’t take effect until 2019.

- Estate tax: The federal estate tax exemption is doubled, resulting in an inflation-indexed exemption of $11.2 million in 2018.

How the 2017 tax law affects standard deductions still has people wondering

As more and more details of the new tax laws are worked into other aspects of existing tax laws, more versatile tax planning must be considered. How are the new tax laws going to change the tax strategies you may have put in place last year or 18 months ago? Everything you have, from your home mortgage, your insurance, retirement funds, kids’ education funds, charitable spending needs to be re-looked. Is there a divorce or separation pending? Major changes in these negotiation choices should give you cause to reconsider any knee-jerk reactions.

What’s the bottom line?

If you’ve never consulted with a CPA tax professional for individual and or business tax strategy, now is the year to do it. This is not the time to pit yourself against the IRS with a DIY tax program or a seasonal pop-up shop tax filer. You’ll very well end up with absolutely nobody working alongside you if the IRS is less than pleased with your returns. The 2017 tax law affects standard deductions and touches just about every aspect of the tax code. How much do you know about the interaction between the IRS tax law and your state tax laws? It’s a whole new ballgame.

We establish and maintain a personal and business relationship with our clients. Your LIFE is your business and your BUSINESS is your life, and we’re here for YOU.

Call us at 479-478-6831. Use my Calendy Page (it’s easy) to set an appointment, or contact me by email melanie@radcliffcpa.com

You may also be interested in:

In July of 2016, we worried about taxes. Who said this?

“Without knowing what tax fallout will rain down on us next year [2017], some taxpayers may feel compelled to wait until 2017 to re-position their tax plans. With that strategy, taxpayers might find themselves in some very uncomfortable positions.”

Had you begun tax strategy planning in 2016, and continued throughout 2017, you could have found yourself well ahead of the game in anticipating your moves relative to the December 2017 tax law changes. Here’s who said it! It’s never too late to start.

What’s the difference between tax avoidance and tax evasion?